Hidden PayPal Fees 2025: What You Need to Know to Avoid Losing Money

With the continuous growth of e-commerce and online transactions, selecting the right payment gateway has become crucial for businesses and consumers. PayPal, one of the most widely used online payment systems at Hac E-Commerce, remains a top choice for many international transactions. However, with the emergence of several alternative payment gateways in 2025, the key question is: How do PayPal fees in 2025 compare to other payment gateways, and which option is more cost-effective? Let’s explore this in detail.

1. PayPal Fees in 2025: Key Changes

PayPal has always been known for its convenience, security, and ability to support international transactions. However, its fee structure has evolved over the years. As of 2025, PayPal continues to apply standard fees for international transactions, with the following details:

- International Trans****action Fees: This fee ranges from 4.4% + a fixed fee (depending on the currency) for international transactions. It may be higher if you receive funds from a country outside your region.

- Currency Conversion Fees: PayPal applies an additional fee for currency conversions when transactions involve different currencies. This fee typically ranges from 2.5% to 4% above the exchange rate.

- Withdrawal Fees: This fee applies when transferring money from your PayPal account to a bank account. The cost varies based on the region and currency used.

While PayPal offers significant security and global acceptance advantages, these fees can be a burden, especially for those conducting frequent international transactions.

2. Alternative Payment Gateways: Fees and Benefits

Aside from PayPal, several other online payment gateways are gaining traction in the market. Some of the most popular and cost-effective alternatives include:

a. Stripe

Stripe is a preferred payment gateway, especially for e-commerce businesses. Its fee structure is as follows:

- Transaction Fees: 2.9% + $0.30 for domestic and 3.9% + $0.30 for international transactions.

- Currency Conversion Fees: 2% per currency conversion.

- Withdrawal Fees: Free for withdrawals to domestic bank accounts.

Stripe stands out due to its lower fees and seamless integration with e-commerce platforms. However, it is only available in selected countries and does not offer buyer protection services like PayPal.

b. Air Wallet

Air Wallet is an emerging digital payment solution for electronic transactions and e-wallet services. Its fees typically include:

- Transaction Fees: Air Wallet charges a percentage-based fee for each transaction, usually 1% to 3%, depending on the country, card type, and transaction value.

- Withdrawal Fees: Some payment gateways charge fees for withdrawing money to a bank account or transferring funds to another e-wallet. These fees typically range from 0.5% to 2%.

- Currency Conversion Fees: International transactions may incur conversion fees ranging from 1% to 3%, depending on exchange rates and service providers.

- Account Maintenance Fees: While some digital wallets charge monthly or annual maintenance fees, Air Wallet may offer free account maintenance for users utilizing basic features.

3. Comparing Fees and Convenience

- Users should carefully review the fees associated with each payment gateway to minimize costs, especially for international transactions and currency conversion.

- Optimizing the payment process and reducing refund transactions can also help save costs.

- Choosing the right payment gateway based on business scale and transaction type is crucial for cost efficiency.

PayPal remains the most widely used and user-friendly payment gateway globally, particularly for small transactions where security is a top priority. Stripe and Wise, conversely, are more suitable for large-scale and cross-border transactions, especially for users aiming to save on currency conversion fees.

Why Choose PayPal?

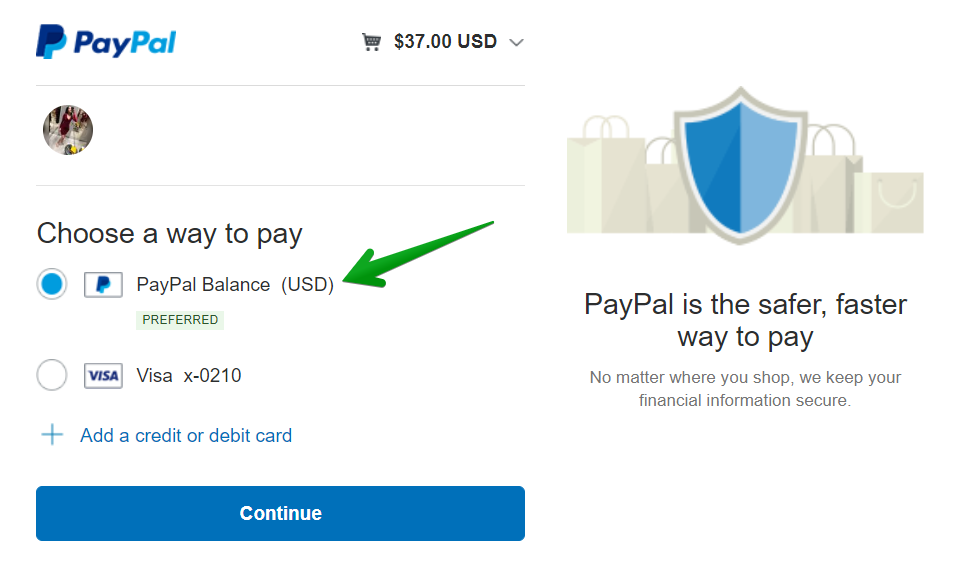

Despite the growing competition from alternative payment gateways, PayPal is an excellent choice for those seeking a simple, secure, and widely accepted payment method. With strong security features, international payment capabilities, and easy integration with various financial systems, PayPal provides a comprehensive payment solution for individuals and businesses.

If you want a convenient online payment method, PayPal remains a top choice in 2025.

Additionally, Hac Ecommerce offers a range of comprehensive services designed to support and empower businesses operating in the POD (Print on Demand) industry. These services include fulfillment solutions, payment account rentals, and design cloning, all of which are tailored to meet the unique needs of entrepreneurs in this niche.