What Is a Payment Gateway? Everything You Need to Know Before Choosing One

In the rapidly growing world of e-commerce and digital transactions, a payment gateway plays a vital role in enabling smooth and secure online payments. Whether you’re running an online store, a dropshipping business, or offering digital services, choosing the right payment gateway can significantly impact your revenue, customer trust, and operational efficiency.

But what exactly is a payment gateway? How does it work, and how do you choose the best one for your needs — especially when considering options like renting a gateway? In this blog post, we’ll break it all down for you.

1. What Is a Payment Gateway?

A payment gateway is a technology that enables merchants to accept credit card, debit card, and other forms of electronic payments from customers. It acts as a bridge between the customer’s payment method (such as Visa, PayPal, or Apple Pay) and the merchant’s bank account.

In simple terms, a payment gateway securely captures payment information, processes it, and transfers the funds to the merchant’s account — all within seconds.

2. How Does a Payment Gateway Work?

Here’s a simplified step-by-step process:

-

Customer Checkout: A customer selects a product or service and proceeds to checkout on your website.

-

Payment Entry: The customer enters their card or payment information.

-

Data Encryption: The gateway encrypts the data and securely sends it to the acquiring bank or payment processor.

-

Authorization: The processor contacts the issuing bank (customer’s bank) to approve or decline the transaction.

-

Confirmation: If approved, the transaction is confirmed, and funds are scheduled to be transferred to your account.

The entire process takes just a few seconds, but it must be secure, reliable, and compliant with financial regulations like PCI DSS.

3. Types of Payment Gateways

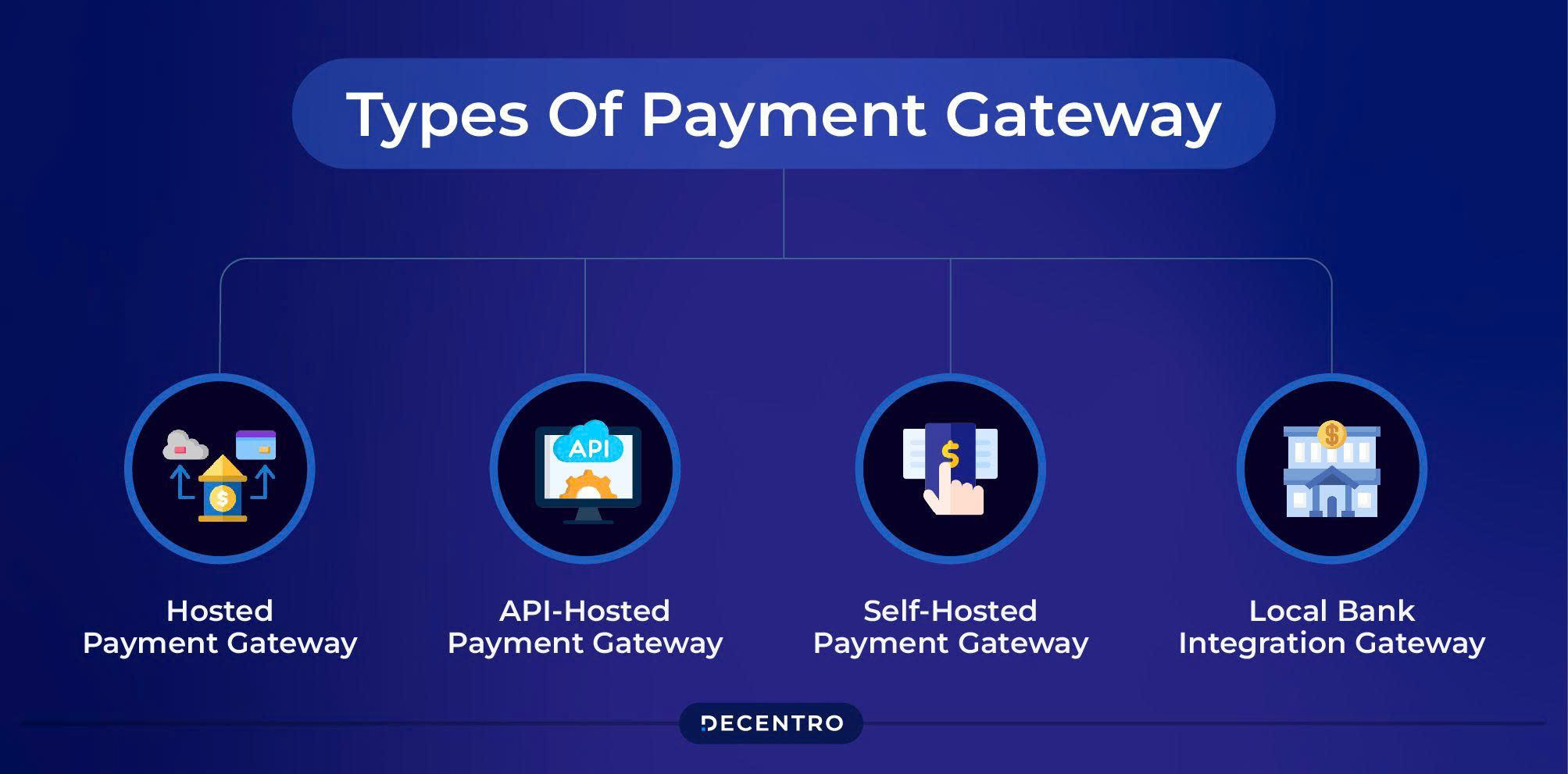

There are three main types of payment gateways:

a. Hosted Payment Gateway

The customer is redirected to a third-party platform (e.g., PayPal or Stripe Checkout) to complete the transaction.

-

Pros: Simple setup, secure, and low maintenance.

-

Cons: Less control over the user experience and branding.

b. Integrated (API-Based) Gateway

The customer stays on your website during the entire checkout process, while the gateway operates in the background.

-

Pros: Seamless user experience and full brand control.

-

Cons: Requires more technical setup and may involve compliance management.

c. Local Bank Gateway

Some businesses prefer local or regional payment processors for domestic transactions. These gateways are often used in specific countries or for niche audiences.

4. Why Businesses Choose to Rent a Payment Gateway

For many online sellers, especially those in the Print-on-Demand (POD) or Dropshipping industries, registering for their own payment gateway (like Stripe or PayPal Business) can be challenging due to verification requirements or regional limitations.

Gateway rental services solve this problem by allowing businesses to “borrow” a verified, functioning payment gateway from a provider. This method is growing in popularity for several reasons:

-

Fast approval and setup

-

Avoids account bans or holds

-

Suitable for international transactions

-

Ideal for short-term projects or testing new markets

Platforms like Hac Ecommerce offer secure and compliant payment gateway rental solutions to help online entrepreneurs get started quickly and scale faster.

5. Key Features to Look for in a Payment Gateway

Before choosing or renting a payment gateway, consider the following factors:

a. Supported Currencies and Countries

Ensure the gateway can process payments from your target markets and customers. Multi-currency support is a must for international sales.

b. Transaction and Conversion Fees

Compare transaction fees, withdrawal fees, and currency conversion rates. Some gateways charge up to 4.4% per international transaction, while others offer lower rates for larger volumes.

c. Security Compliance

Choose gateways that are PCI-DSS compliant and offer fraud protection tools such as 3D Secure, tokenization, and anti-chargeback features.

d. Integration and Compatibility

Make sure the gateway is compatible with your website builder (e.g., Shopify, WooCommerce, Wix) and e-commerce tools like automation apps or invoicing software.

e. Payout Schedule

Understand how often the gateway pays out your earnings. Some offer daily payouts, while others may take 3–7 business days.

6. Popular Payment Gateways in 2025

Let’s take a quick look at some leading payment gateways:

| Payment Gateway | International Fee | Currency Conversion | Buyer Protection | Ideal For |

|---|---|---|---|---|

| PayPal | 4.4% + fixed fee | 2.5%–4% | Yes | Small sellers, freelancers |

| Stripe | 3.9% + $0.30 | 2% | No | Businesses with API needs |

| Wise | ~0.5% | Real-time exchange | No | Low-cost cross-border |

| AirWallet | 1%–3% | 1%–3% | Limited | POD, dropshipping |

7. Is Renting a Gateway Right for You?

If you’re a new seller, facing account restrictions, or need fast access to a verified gateway, gateway rental services are a smart and practical option.

They offer:

-

Quick setup

-

Flexibility

-

Lower risk of account limitations

-

Access to trusted platforms like PayPal or Stripe without going through full registration

At Hac Ecommerce, we help online sellers access secure and efficient payment systems tailored to their needs — whether short-term or long-term.

Conclusion

Understanding how payment gateways work — and selecting the right one — is crucial for any online business. Whether you own a full-scale store or run a side hustle, payment efficiency, security, and cost-effectiveness directly affect your revenue and growth.

And if you’re looking to bypass account setup headaches, renting a payment gateway might be your best move in 2025.

Explore gateway rental options today and take control of your online payments — the smart, simple, and scalable way.

Additionally, Hac Ecommerce offers a range of comprehensive services designed to support and empower businesses operating in the POD (Print on Demand) industry. These services include fulfillment solutions, payment account rentals, and design cloning, all of which are tailored to meet the unique needs of entrepreneurs in this niche.